The temptation of possible gains in the fast-paced world of foreign exchange trading frequently pushes investors to investigate other options, but the dangers of working with unregulated forex brokers overshadow the apparently good prospects.

In this in-depth guide you’ll learn about:

Various Unregulated Forex Brokers

The risk involved in unregulated Forex trading

Pros and Cons Unregulated Forex Brokers

Unregulated Forex Broker list

Details on there licenses

And lots more…

Let’s dive right in…

Unregulated Forex Brokers (2023)

| 𝗕𝗿𝗼𝗸𝗲𝗿 | 𝗗𝗲𝘁𝗮𝗶𝗹𝘀 |

|---|---|

| 📌 EagleFX | Unregulated |

| 📌 LQDFX | Unregulated |

| 📌 LMFX | Unregulated |

| 📌FxGlory | Unregulated |

| 📌CFreserve | Unregulated |

| 📌 FreshForex | Unregulated |

| 📌 Coinexx | Unregulated |

| 📌 TBFX | Unregulated |

| 📌 CFD Royal | Unregulated |

| 📌 FX Options24 | Unregulated |

| 📌 247SmartFx | Unregulated |

| 📌 LionsFM | Unregulated |

| 📌 WDC Markets | Unregulated |

| 📌 Royaltd24 | Unregulated |

| 📌 RoyalsFX | Unregulated |

| 📌 Spectre.ai | Unregulated |

| 📌 Concept4X | Unregulated |

| 📌 FxFixed | Unregulated |

| 📌Primus Forex Financial Group | Unregulated |

| 📌Videforex | Unregulated |

| 📌Meta Finance Trade | Unregulated |

| 📌 Capital GMA | Unregulated |

| 📌Ostrich Capital | Unregulated |

| 📌 AAG Markets | Unregulated |

| 📌CVC Markets | Unregulated |

| 📌 JustProForex | Unregulated |

| 📌 GoldenSkyCapital | Unregulated |

| 📌 FernFX | Unregulated |

| 📌 Uniglobe Markets | Unregulated |

| 📌 CobraCFD | Unregulated |

| 📌 Elite Trading | Unregulated |

| 📌 FXprime | Unregulated |

| 📌 AnyTrades | Unregulated |

| 📌FX NextGen | Unregulated |

| 📌 Smartoptionfx | Unregulated |

| 📌PrimeXBT | Unregulated |

| 📌 TradersWay | Unregulated |

| 📌 MidasGlobe | Unregulated |

| 📌 Kronosinvest | Unregulated |

| 📌 Binomo | Unregulated |

| 📌 Trade Global Market | Unregulated |

| 📌 First BTC FX | Unregulated |

| 📌 EssenceFX | Unregulated |

Definition of Unregulated Forex broker

Licensed forex brokers are audited, reviewed, and regularly evaluated to ensure they adhere to industry standards. This ensures that all currency trading is both ethical and equitable for all parties involved.

Each nation has a regulatory body that establishes the framework of laws that must be followed while trading forex. Each currency regulatory authority is self-governing, and regulation and enforcement vary by nation.

Unregulated Forex Brokers – 48 Keypoint Overview

- ✅Unregulated Forex Brokers (2023)

- ✅Definition of Unregulated broker

- ✅Unregulated Forex Brokers

- ✅EagleFX

- ✅LQDFX

- LMFX

- FxGlory

- CFreserve

- FreshForex

- Coinexx

- TBFX

- CFD Royal

- FX Options24

- 247SmartFx

- LionsFM

- WDC Markets

- Royaltd24

- RoyalsFX

- Spectre.ai

- Concept4X

- FxFixed

- Primus Forex Financial Group

- Videforex

- Meta Finance Trade

- Capital GMA

- Ostrich Capital

- AAG Markets

- CVC Markets

- JustProForex

- GoldenSkyCapital

- FernFX

- Uniglobe Markets

- CobraCFD

- Elite Trading

- FXprime

- AnyTrades

- FX NextGen

- Smartoptionfx

- PrimeXBT

- TradersWay

- MidasGlobe

- Kronosinvest

- Binomo

- Trade Global Market

- First BTC FX

- EssenceFX

- Conclusion

- Frequently Asked Questions

Top 10 Forex Brokers Broker Rating Regulators Min Deposit Leverage Website Top 10 Forex Brokers Broker Rating Min Deposit Leverage

EagleFX

EagleFX is a reputable but unregulated online broker that is based in Dominica. EagleFX has been in operation since 2019 and has a global customer base that prefers to trade online with them. The broker offers over a hundred trading products, including cryptocurrency trading 24 hours a day.

Additionally, they provide a diverse range of Forex currencies and CFDs that may be traded under favorable trading circumstances, including tight spreads, fast execution, and intuitive trading interfaces that are jam-packed with valuable trading features.

LQDFX

LQDFX was established in 2015, and headquarters can be found in the Marshall Islands. LQDFX is an STP and ECN online trading broker that provides online trading in Forex, Metals, Commodities, and Indices through the reputable MetaTrader 4 trading platform for desktop, web, and mobile.

While the broker is not licensed, he segregates customer cash and adheres to tight security protocols. LQDFX also guarantees STP trade executions and provides PAMM accounts, daily market news, and training are all available to clients.

LMFX

Found in 2015, LMFX is an STP broker headquartered in the Republic of Macedonia that allows the trade in a range of Forex and CFD instruments.

LMFX offers customers a variety of handy trading calculators and the MetaTrader 4 (MT4) platform for desktop, online, and mobile trading. Additionally, they provide a variety of instructional video courses via the LMFX Education Centre to assist customers in expanding their trading knowledge.

FxGlory

Established in 2011 and based in the UAE, FxGlory is one of the best market makers that offer a wide range of forex and CFD trading options. FxGlory offers access to MetaTrader 4 across devices.

FxGlory is unregulated, and traders are urged to heed caution when using this broker. FXGlory provides traders with large leverage, no fees, and fast executions. Most of the management team are experienced traders and investors who understand what other retail traders need.

As a result, the company's purpose is to meet the demands of all customers and partners.

CFreserve

CFreserve is an online financial services company that allows clients a wide range of financial instruments spread across forex, gold, commodities, and several others using a proprietary trading platform that is available in web and mobile versions. There is a $250 minimum deposit, reasonable spreads, and 1:10 leverage.

FreshForex

Founded in 2004, FreshForex is an unregulated ECN and STP forex trading broker headquartered in Saint Vincent and the Grenadines. The brokerage utilizes ‘Smart Bridge' technology and provides trading indications to customers in addition to daily market analyses.

FreshForex's online trading platform, MetaTrader 4 (MT4), and MetaTrader 5 (MT5) support over 130 trade instruments and accepts various trading styles and tactics.

Coinexx

Online brokerage Coinexx offers some of the lowest spreads from 0.0 pips for Forex and cryptocurrencies, with low and competitive commissions. The broker accepts crypto for both deposits and withdrawals, and there are no fees involved.

Coinexx has been in operation since 2018 and is headquartered in 2018. There is no regulatory information for the broker, and the firm offers MetaTrader 4 and MetaTrader 5.

TBFX

TBFX is an unregulated broker in the United Kingdom that claims to have over 14 years’ worth of experience in several financial markets. Investigations into the operations of TBFX identified the broker as a clone of a regulated financial institution, leading to the broker being blacklisted by the Financial Conduct Authority and other market regulators.

CFD Royal

Elite Property Vision LTD, with a registered address in Sofia, Bulgaria, owns and operates CFD Royal. The broker, however, is neither authorized nor regulated by the Bulgarian Financial Supervision Commission or any other agency. United Limited, an offshore entity domiciled in the Marshall Islands, previously owned CFD Royal.

CFD Royal offers clients a wide range of markets that can be traded through sophisticated trading platforms. In addition, the broker also claims to feature competitive trading conditions suited to all types of traders.

FX Options24

FX Options24 is an unregulated broker as well as a clone company that claims to be regulated, but all registrations lead to JFD Group, Limited, which is not associated with FX Options24.

FX Options 24 offered traders a wide range of tradable instruments across several platforms, promising some of the best trading conditions and fast trade executions, which was found to be a way for this scam broker to lure unsuspecting traders in.

247SmartFx

247SmartFx is an unregulated broker that is in Germany and is owned and operated by Game Capital Ads Limited. According to the broker’s official website, 247SmartFx is an emerging leader in financial trading, providing premium trading services for all types of traders.

However, 247SmartFx is a blacklisted broker on the website of the Cyprus Securities and Exchange Commission. This broker does not have the authorization to offer financial services or products within Cyprus.

LionsFM

LionsFM is an entity that is registered in the Marshall Islands and is operated by Equal Target Limited. The entity claims to possess over ten years of experience in financial markets and offers low-risk assets.

This broker was previously blacklisted by the FMA, a market regulator in Australia. The website for LionsFM is no longer active, and it is safe to assume that this entity is no longer in business because of its fraudulent nature.

WDC Markets

WDC Markets is an unregulated broker that is owned and operated by FTG Solutions Limited, which is registered in the British Virgin Islands and operates from Estonia.

WDC Markets has been blacklisted by two regulators, namely the FMA in New Zealand and the CNMV from Spain. The FMA blacklisted the firm because of concerns that the broker was withholding client funds and because of several scam reports.

According to the CNMV, WDC Markets is unauthorized to provide investment services, including investment advice.

Royaltd24

Royaltd24 is owned and operated by RL Limited, a company registered in the Marshall Islands. The broker claims to have been established in 2011 by a group of economists with experience in several financial markets.

The broker offered investors forex and CFD instruments with leverage up to 1:200, variable and fixed spreads, and low commission charges. However, CONSOB has blacklisted Royaltd24 because of numerous scam reports.

Top 10 Forex Brokers Broker Rating Regulators Min Deposit Leverage Website Top 10 Forex Brokers Broker Rating Min Deposit Leverage

RoyalsFX

RoyalsFX is based in Geneva, Switzerland and the broker's website indicates that it falls under the Estonian Governing law. However, the regulatory and licensing status of the broker cannot be verified.

In addition, there is no mention of this entity in the register of local regulators, which indicates that this broker is not a legitimate company or a trusted forex broker.

In addition, RoyalsFX has been blacklisted by the Financial Conduct Authority (FCA) in the United Kingdom.

Spectre.ai

Established in 2018, Spectre.ai is an online trading platform based in Kingstown, Saint Vincent, and the Grenadines, where traders may trade binary options directly on more than 50 financial assets, like currency, equities, bonds, ETFs, and more.

They are quick to execute transactions and use risk control features built right into the platform. Traders need not deposit any money to begin trading.

Concept4X

Concept4X is an unregulated broker that is owned and operated by AllGren Capital Limited, based in Dominica. One of the world's fastest-growing and finest Forex trading platforms is Concept4X, according to the company website.

A quick learning curve, a user-friendly design, and top-notch customer service make Concept4X the greatest online trading platform available. However, Concept4X appears on a warning list issued by the Cyprus Securities and Exchange Commission (CySEC) in 2020, which means that this broker is likely to be a scam.

FxFixed

FxFixed is an unregulated broker that is owned and operated by Unigreen Korlatolt Felelossegu Tarsasag in Hungary. In addition to not providing any regulatory data or contact information, the CNMV has placed FxFixed on a list of prohibited brokers in Spain.

Primus Forex Financial Group

Primus Forex Financial Group is a clone of the forex trading firm Primus Capital Markets UK Limited, which operates under the name Primus Forex Financial Group. Primus Forex Financial Group is not authorized to conduct business in the United Kingdom or any other country.

Videforex

Videforex is a market-maker online trading broker based in Seychelles that has been in operation since 2016. Videforex broker is a Forex, CFDs, and Options trading platform that can be used online.

They provide traders with a customized trading platform for online and mobile, as well as several practical choices for financing trading accounts.

Meta Finance Trade

According to Meta Finance Trade, traders have access to 80 major currency pairs, minors, and exotic pairs. The broker also claims to offer competitive spreads, low commission charges, and more.

However, there is no better example of a clone company than Meta Finance Trade. To persuade investors that they are dealing with the legitimate business, clone corporations utilize all or parts of the information of the legitimate entity they are based on.

The Cyprus Securities Exchange Commission (CySEC) has included Meta Finance Trade on its warning list, which means that this broker is a scam.

Capital GMA

Capital GMA is operated by Equalizer Limited, which is registered in Bulgaria according to its official website. However, when evaluating this information, it could not be verified on the register of the Bulgarian Financial Supervision Commission.

Capital GMA is a scam broker that has been blacklisted by the Italian market regulator, CONSOB. The website for Capital GMA is no longer operational, and this entity is no longer in business.

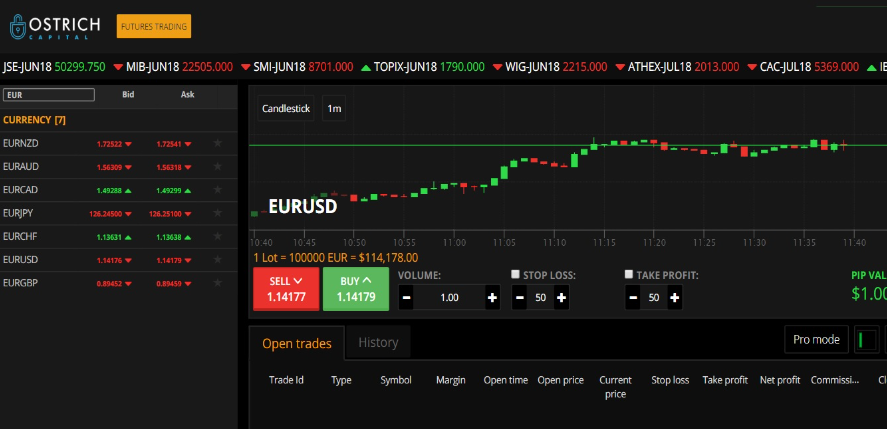

Ostrich Capital

Venture Gravity LTD owns and operates Ostrich Capital, a Forex and CFD trading platform. Although the business is situated in London, the United Kingdom, it is not approved by the Financial Conduct Authority and is not targeting residents of the United Kingdom.

Ostrich Capital, according to information on the regulator's website, is engaged in regulated activities that require authorization. Additionally, the FCA has published a cautionary statement on this broker.

AAG Markets

Established in 2006 and headquartered in Saint Vincent and the Grenadines, AAG Markets is an unregulated STP forex broker that offers commodities, forex, indices, CFDs, and forex pairs.

The broker offers a range of trading account options, educational resources, and the use of MetaTrader through which trades can be carried out.

CVC Markets

CVC Markets is an online trading broker based in Saint Vincent and the Grenadines that offers traders the MetaTrader 4 trading platform for trading currencies, commodities, indices, stocks, metals, and CFDs.

Traders can enjoy competitive trading circumstances such as no dealing desk involvement, several account choices, variable leverage, and spreads starting at 0.0 pips.

JustProForex

JustProForex is an online broker based in Vanuatu, offering clients access to a wide range of markets, competitive commissions, and positive slippage.

The broker is unregulated and has been misinforming customers. In addition, the Cyprus Securities and Exchange Commission has JustProForex on its warning list, which further proves that this is a scam broker.

GoldenSkyCapital

GoldenSkyCapital is an offshore company that is owned and operated by Golden Point, Ltd. The company is incorporated in the Marshall Islands and claims to offer innovative and safe trading across several asset classes.

The only contact information available for the broker is a phone number with a Swiss region code. However, the broker is not regulated in Switzerland, and the Swiss regulator FINMA has issued a warning against GoldenSkyCapital, which means that this broker is a scam.

FernFX

FernFX is an unregulated broker that is owned by FERN GROUP NZ LIMITED and is based in Auckland, New Zealand, according to the company's website. According to the broker's official website, FERN GROUP NZ LIMITED is a worldwide supplier of foreign currency investment and industry solutions headquartered in New Zealand and authorized by the country's financial services regulator, the FSP.

According to the broker's website, FernFX offers Forex and CFD products to worldwide financial institutions, organizations, and people as a prominent global investment service provider. However, it was discovered that the broker was just utilizing the name of the New Zealand-regulated organization without possessing a valid financial services license.

In addition, the New Zealand market regulator has issued a warning against FernFX, which indicates that traders should avoid this broker.

Uniglobe Markets

Headquartered in the Marshall Islands, Uniglobe has been in operation since 2014, offering ECN and STP trade executions in several asset classes.

Uniglobe Markets provides its clients with a choice between flexible trading accounts, competitive trading conditions, and access to MetaTrader 4 across several devices.

CobraCFD

Owned and operated by CobraCFD, Ltd. and Kings Power, Ltd, CobraCFD operates from the Marshall Islands. CobraCFD claims that it offers trading choices in a range of popular liquid assets, including currency pairings, equities, most important financial indexes, and commodities.

However, this broker has been blocked by the Italian regulator CONSOB, and the official website of the broker is no longer operational.

Top 10 Forex Brokers Broker Rating Regulators Min Deposit Leverage Website Top 10 Forex Brokers Broker Rating Min Deposit Leverage

Elite Trading

Elite Trading is an Estonian broker that is operated by Netbit Services and Solutions Limited. There is no information available on the regulatory status of Elite Trading despite the broker claiming that the Estonian Financial Supervision Authority regulates it.

The Belgian Regulator has blacklisted elite Trading, FSMA, because of several complaints received from clients regarding fraudulent online trading platforms such as Elite Trading.

FXprime

FXprime claims that it is the market leader in the foreign exchange and contract for difference (CFD) sectors. It pledges to provide a robust, user-friendly, and transparent trading platform. FXprime's trading platform enables customers to take advantage of narrow spreads and minimal fees.

However, there are several warnings against this broker, and it appears on the warning list of the Belgian regulator FSMA. Several clients have complained about fraudulent online brokers operating in the market, of which FXprime is one.

AnyTrades

Founded by a group of experienced Forex traders, software engineers, and financial specialists, AnyTrades is a retail online trading broker that serves investors from across the globe.

Clients from all around the world may access the broker's comprehensive choice of financial instruments and services, trading software, and trading strategies via its offices in Denmark, Gibraltar, Liechtenstein, Vanuatu, and Malta.

FX NextGen

FX NextGen is an offshore broker that claims to be registered in the Republic of Georgia. However, there is no other information on the regulatory status of the broker.

Austria's FMA has previously issued a warning against FX NextGen, indicating that the broker is prohibited from providing financial services or carrying out banking transactions on a commercial basis.

Smartoptionfx

B.O. TradeFinancials Ltd owns Smartoptionfx and claims to be based in the United States. According to the official website of the broker, it is one of the safest and most secure binary and forex trading platforms that offers real-time results.

However, several reputable regulatory organizations ban this broker, and traders are urged to avoid doing business with it.

PrimeXBT

PrimeXBT is an online trading platform for aggressive traders that is based on Bitcoin.

The broker provides a diverse range of trading products, including cryptocurrencies, foreign exchange currency pairings, stock indexes, and commodities. With a leverage of up to 1:100, traders can easily trade both long and short positions on a safe and user-friendly trading platform.

TradersWay

Established in 2011, Traders Way is a Market Maker, STP, and ECN Dominican-based broker.

They provide narrow spreads starting at 0 pips, cheap fees, and lightning-fast trade execution with the use of ECN technology. The broker offers a variety of deposit and withdrawal methods, as well as leverage of up to 1:1000 and round-the-clock client service.

MidasGlobe

MidasGlobe provides hundreds of trading assets like Forex, Energies, Metals, and Futures, as well as the option of immediate access and comprehensive account management.

The broker is a brand of Valley Marketing Ltd, which claims to be compliant with EU Regulations and to have its headquarters in Bulgaria.

However, there are several warnings from market regulators against MidasGlobe, and the broker's terms and conditions are outrageous and unfair, indicating that this broker is a scam.

Kronosinvest

Since 2010, Kronosinvest has provided a variety of services in Forex and CFDs on commodities, indices, and stocks. The broker claims to be regulated by the Estonian market regulators. However, there is no proof that this is true because no records on the market regulator’s site indicate this.

Furthermore, Kronosinvest has been blacklisted by CONSOB, providing evidence that this broker is a scam and that traders will lose money if they invest funds with this broker.

Binomo

Binomo is a broker that is based in Saint Vincent and the Grenadines that has been around for the past several years. Binomo is an online trading platform that serves both beginner and expert traders. The broker provides a variety of trading services, including training for professionals, analytical tools, and customer assistance.

Top 10 Forex Brokers Broker Rating Regulators Min Deposit Leverage Website Top 10 Forex Brokers Broker Rating Min Deposit Leverage

Trade Global Market

Trade Global Market is a forex and CFD broker that is based in Tbilisi, Georgia, and is owned and run by TGM Financial LLC.

Trade Global Market asserts that it is a prominent online trading firm specializing in providing services to individuals and businesses in worldwide financial markets. The broker provides trading in a variety of currency pairings, as well as gold (Spot), silver (Spot), CFDs, and indices.

This broker is not regulated with the National Bank of Georgia, and the contact information offered on the official website is incorrect.

First BTC FX

First, BTC FX is a forex, contract for difference (CFD), and cryptocurrency broker. Since 2013, the website states, the firm has provided high-quality commodities and forex trading services. First Global (UK) Limited claims ownership and operation in the UK.

The broker claims to have regulations with the Financial Conduct Authority and the Cyprus Securities and Exchange Commission, but this is false. Subsequently, First BTC FX has been blacklisted by the FCA because it is a clone of a legitimate FCA-authorised broker.

EssenceFX

EssenceFX was owned and operated by Essence Markets Limited, registered in Vanuatu. EssenceFX claimed to be a global broker that offered comprehensive currency trading solutions as well as services.

These claims were dispelled, and EssenceFX was subsequently blacklisted by several market regulators.

Conclusion

In conclusion, traders who deal with unregulated forex brokers run a serious danger of fraud, inadequate investor protection, and unstable trading conditions. Securing a safe trading environment and protecting one's capital necessitate using licensed and trustworthy forex brokers who follow industry guidelines and legal requirements.

Disclaimer

Trading foreign currencies on margin carries a high level of risk and it may not be suitable for all traders and investors. Forex is a highly leveraged financial instrument and these high-risk stakes can result in you losing a substantial amount of money. Consider your appetite for risk before trading forex using real money on a live account.

You might also like: AvaTrade Review

You might also like: Exness Review

You might also like: HF Markets Review

You might also like: Tickmill Review

You might also like: Best Forex Brokers with no Deposit Bonus

Frequently Asked Questions

What is the difference between unregulated forex brokers and offshore forex brokers?

An offshore forex broker is defined as a corporation registered in an offshore country outside of the trader's region that provides online forex trading services. There are various reasons why forex brokers opt to establish their forex trading firm in an offshore jurisdiction. This includes lower taxation, fast set-ups, low maintenance costs, and it is easier to get offline licenses.

Not all unregulated forex brokers are offshore brokers, and traders will find that many local forex brokers in their region are unregulated. Unregulated brokers are not authorized by any market regulator to provide financial services and products, making them extremely dangerous to deal with.

Are unregulated forex brokers illegal?

No, not all unregulated forex brokers are illegal. They are not considered illegal if they conduct honest activities and they do not provide false or misleading information, steal funds, or pretend to be a regulated entity.

What is an unregulated forex broker?

An unregulated forex broker is a company that facilitates trading across several financial markets, offering a range of tradable instruments and financial services without being regulated by a regulatory entity.

Table of Contents