Overall, Tickmill is recognized as a global financial services provide and has emerged as a pivotal player in the dynamic landscape of online trading, consistently delivering innovative solutions and fostering a commitment to empowering traders worldwide

In this in-depth review you’ll find the following information:

- A complete overview of Tickmill broker

- Tickmill minimum deposit amount details

- An overview of all Tickmill Account Types

- Details surrounding Tickmill Demo account

- Steps to sign up for Tickmill real account

- Steps to make a withdrawal from Tickmill

- Tickmill vs AvaTrade vs HF Markets

- Details on how to log into Tickmill account

- Pros and Cons of Tickmill

- Tickmill sign-up bonus details

And lots more…

Let’s dive right in…

Tickmill at a Glance

| 𝗕𝗿𝗼𝗸𝗲𝗿 | 𝗧𝗶𝗰𝗸𝗺𝗶𝗹𝗹 |

|---|---|

| 📜 Regulated | FCA, BaFin, CONSOB, ACPR, CNMV |

| 🎁 Sign Up Bonus | $30 USD Welcome Bonus |

| 🕖 Time to open an account | 1 day |

| 🔥Live support | 24/5 |

| 📊Trading Islamic Account | Yes, available |

| 💳 Demo Trading Account | Yes |

| 💰Spreads | 1.6 pips |

| 💰Leverage | 1:500 |

| 💰 Minimum deposit | $100 USD |

| 📙 Website Languages | English, Indonesian, Polski, Melayu, Deutsch, Russian, Italian, Vietnamese, Chinese, Español, Korean, Portuguese, Arabic, Thai |

| 💵 Account currencies | USD, EUR, GBP, ZAR |

| 🥇 Trading Instruments | Forex, Stock Indices, Commodities, Bonds, Cryptocurrencies, Stocks |

| 📈 Trading Platforms | MT4, MT5, WebTrader |

| 🎓Affiliate Program | Yes |

| 🚀 Open a account | 👉Click Here |

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

MT4, MT5

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Tickmill Review – 21 Keypoint Overview

- ✅ Tickmill at a Glance

- ✅ Tickmill Overview

- ✅ Is Tickmill Regulated?

- ✅ Tickmill Minimum Deposit

- ✅ Types of Tickmill Accounts

- Tickmill Sign-Up Bonus

- Tickmill Demo Account

- Tickmill Islamic Account

- How to Open an Tickmill Account – Step-by-Step Guide

- Tickmill Pros and Cons

- Tickmill VS AvaTrade VS HF Markets – Comparison Table

- Tickmill Customer Reviews

- Deposits and Withdrawal

- Steps to Withdraw Funds from Tickmill Account

- Tickmill Fees, Spreads, and Commission

- Tickmill Social Trading

- Tickmill Partnership Options

- Tickmill Product Portfolio

- Tickmill Broker Trading Platforms

- Conclusion

- Frequently Asked Questions

Tickmill Overview

| 🔎 𝗕𝗿𝗼𝗸𝗲𝗿 | 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 💰 𝗠𝗶𝗻𝗶𝗺𝘂𝗺 𝗗𝗲𝗽𝗼𝘀𝗶𝘁 | 🌎 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘀 |

|---|---|---|---|

| Tickmill | 👉Click Here | $100 USD | FCA, BaFin, CONSOB, ACPR, CNMV |

Tickmill is an award-winning ECN broker headquartered in London that offers to trade in forex, commodities, and indices.

Tickmill Ltd was founded in 2014 and is a member of the global Tickmill Group. Today, the broker operates in over 200 countries with an average monthly trading volume of 121bn+. Tickmill has multiple offices worldwide with over 200 staff and more than 50 000 customers.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Is Tickmill Regulated?

Yes, Tickmill UK Ltd is regulated in the UK by the Financial Conduct Authority (FCA) and as a trading name of Tickmill Ltd, also regulated by the Seychelles Financial Services Authority (FSA).

Tickmill Europe Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), Tickmill Asia Ltd is authorized and regulated by the Labuan Financial Services Authority, and Tickmill South Africa (Pty) Ltd, is authorized and regulated by the Financial Sector Conduct Authority (FSCA).

| 🥇 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘀 | 📌 𝗔𝗯𝗯𝗿𝗲𝘃𝗶𝗮𝘁𝗶𝗼𝗻 | 🔎 𝗟𝗶𝗰𝗲𝗻𝘀𝗲 𝗻𝘂𝗺𝗯𝗲𝗿 |

|---|---|---|

| 🥇 Financial Services Authority | 🖋 FSA | SD008 |

| 🥈 Dubai Financial Services Authority | 🖋 DFSA UAE | F007663 |

| 🥉 Labuan Financial Services Authority | 🖋 Labuan FSA | MB/18/0028 |

| 🥇Financial Conduct Authority | 🖋 FCA | 717270 |

| 🥈Cyprus Securities and Exchange Commission | 🖋 CySEC | 278/15 |

| 🥈Financial Sector Conduct Authority | 🖋 FSCA | FSP 49464 |

Tickmill Minimum Deposit

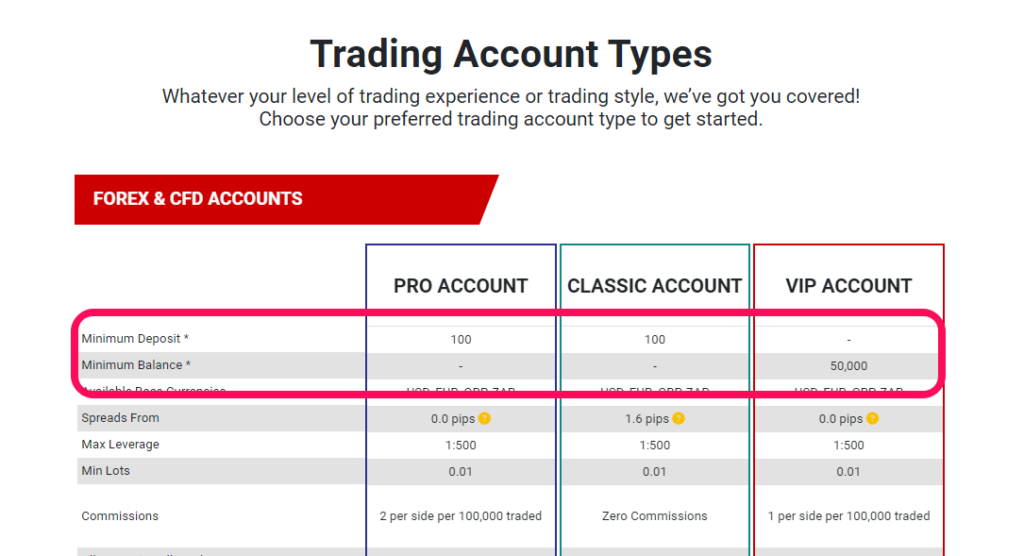

Depending on the payment method used, the minimum deposit for a Pro trading account is $100 USD overall. The minimum ZAR deposit is equal to the difference in trading value between USD and ZAR.

| 💻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 💰 𝗠𝗶𝗻𝗶𝗺𝘂𝗺 𝗗𝗲𝗽𝗼𝘀𝗶𝘁 |

|---|---|---|

| 🔎 Pro | 👉Click Here | $100 USD |

| 🔎 Raw | 👉Click Here | $100 USD |

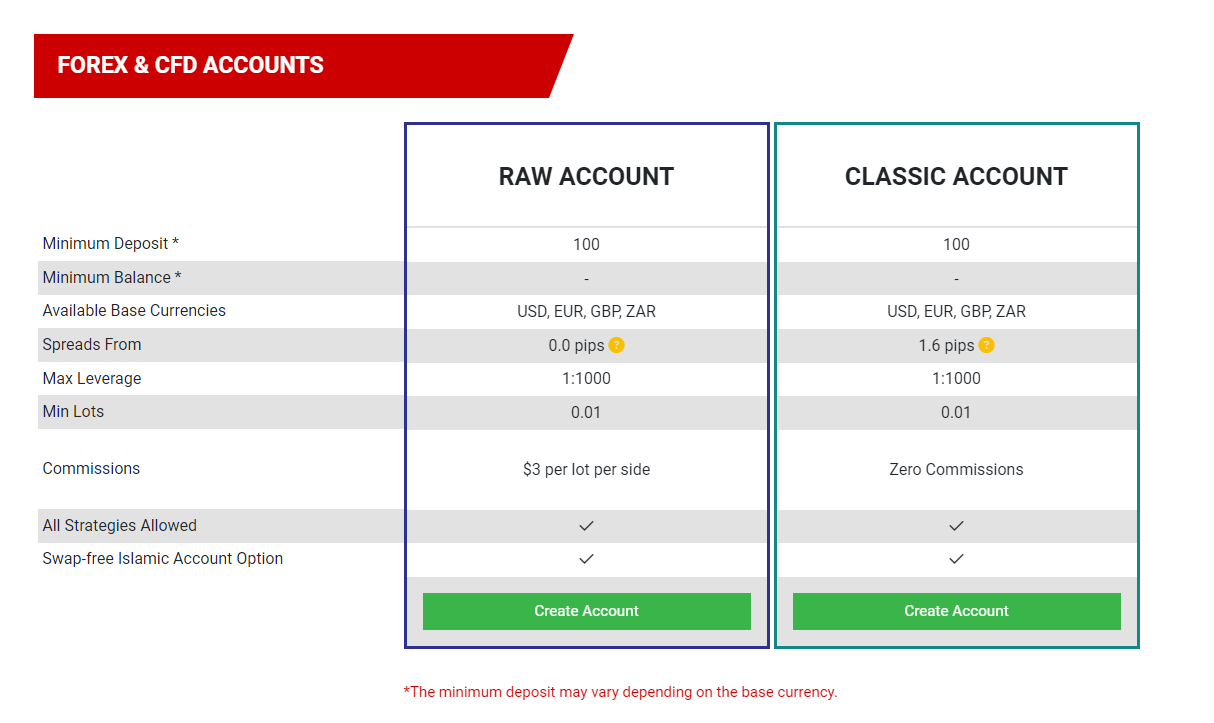

Types of Tickmill Accounts

Classic Account

The classic account offers trade-in CFDs on 62 currency pairs, major stock indices, oil, precious metals, and bonds, with variable spreads starting from 1.6 pips and no commissions. It is suitable for novice and experienced traders and offers ultra-fast order execution using virtually any trading strategy. It has the following features:

- The minimum deposit is $100

- Available Base Currencies are USD, EUR, and GBP

- Spreads start from 1.6 pips

- Max Leverage is 1:500

- Min Lots – 0.01

- Zero Commissions

- All Strategies Allowed

- Swap-free Islamic Account option available

| 💻 𝗔𝘀𝗽𝗲𝗰𝘁𝘀 | 🥇 𝗖𝗹𝗮𝘀𝘀𝗶𝗰 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 |

|---|---|

| Maximum leverage | 1:500 |

| Minimum deposit | $100 USD |

| Spread | 1.6 pips |

| Commission | Zero Commissions |

| Minimum lot size | 0.01 |

| Swap-free | Yes |

| 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 👉Click Here |

Raw Account

The Raw Account is designed with advanced features and optimal conditions for experienced traders with fluctuating spreads starting from 0.0 pips. Other features include:

- Minimum Deposit of $100

- Available Base Currencies are USD, EUR, GBP, ZAR

- Spreads start from 0.0 pips

- Max Leverage is 1:1000

- Min Lots – 0.01

- Commissions – $3 per lot per side

- All Strategies Allowed

- Swap-free Islamic Account option available

| 💻 𝗔𝘀𝗽𝗲𝗰𝘁𝘀 | 🥇 Raw 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 |

|---|---|

| Maximum leverage | 1:1000 |

| Minimum deposit | $100 USD |

| Spread | 0.0 pips |

| Commission | $3 per lot per side |

| Minimum lot size | 0.01 |

| Swap-free | Yes |

| 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 👉Click Here |

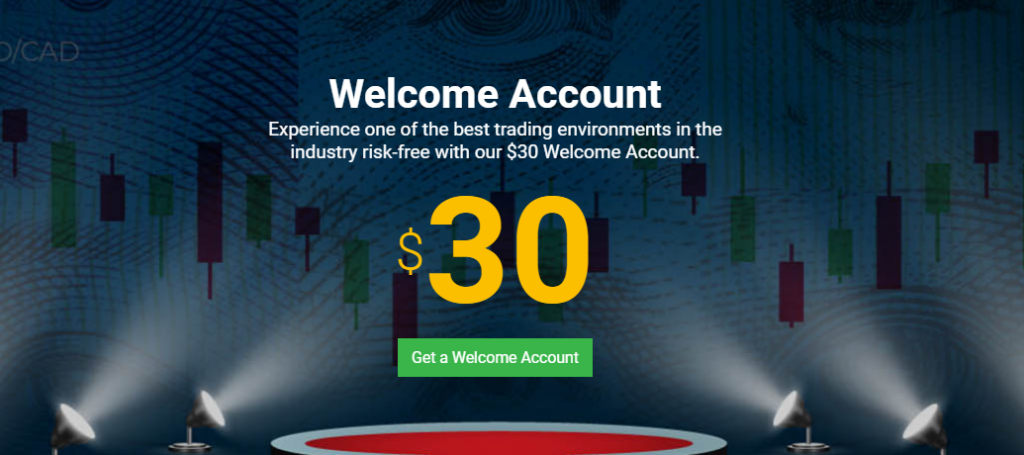

Tickmill Sign-Up Bonus

Tickmill offers a Sign up/ welcome bonus to all new traders that sign up with an account.

| 𝗙𝗲𝗮𝘁𝘂𝗿𝗲𝘀 | 𝗗𝗲𝘁𝗮𝗶𝗹𝘀 |

|---|---|

| 🥈Broker | Tickmill |

| 💰 Sign Up Bonus | Yes |

| 📝Partnership Option | Yes |

| 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 👉Click Here |

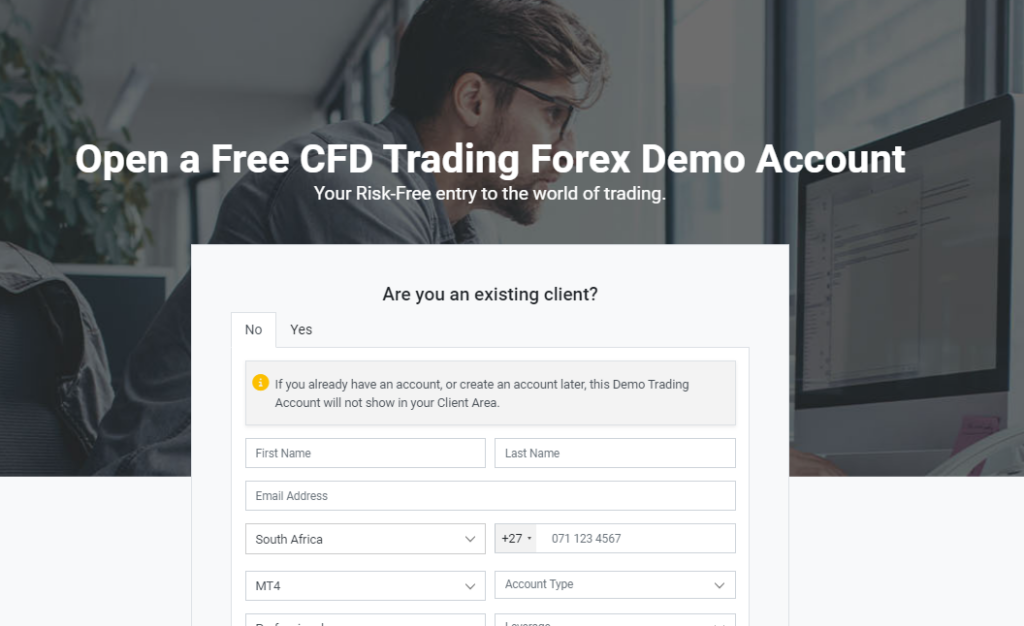

Tickmill Demo Account

The free demo account offers traders trading in real-time, with tools and strategies to test and sharpen their trading skills in a completely risk-free environment. It is a full-featured account with which traders can explore the full suite of customizable tools and features that the MT4 platform provides to trade 80+ trading instruments across 4 asset classes.

| 𝗙𝗲𝗮𝘁𝘂𝗿𝗲𝘀 | 𝗗𝗲𝘁𝗮𝗶𝗹𝘀 |

|---|---|

| 🥈Broker | Tickmill |

| 💰 Demo Account | Yes |

| 📝Virtually Funded | Not Indicated |

| 💻Terminal Access | Full |

| 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 👉Click Here |

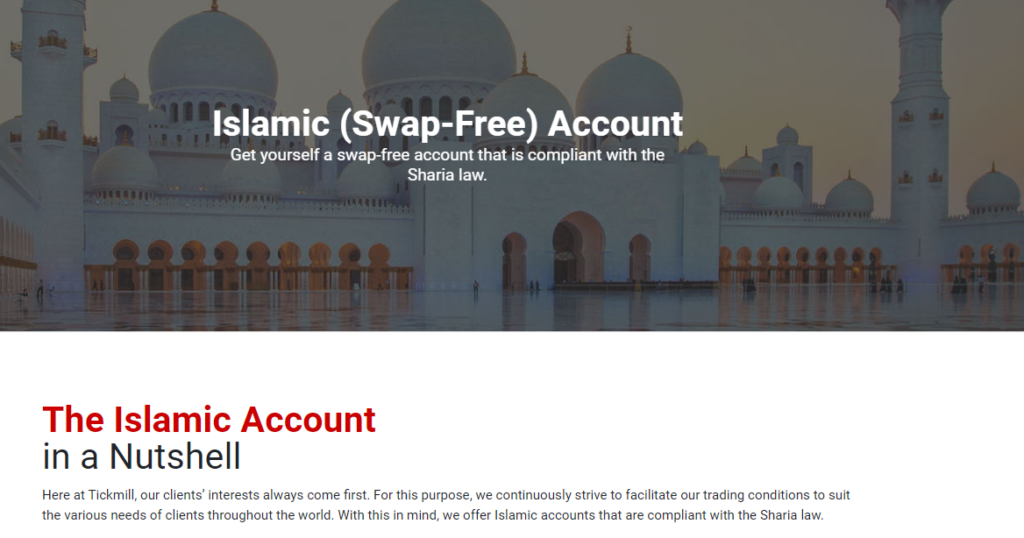

Tickmill Islamic Account

Tickmill offers swap-free options that are compliant with Sharia law on all the above account types.

The Tickmill support team will process requests for Islamic account status within one business day. Any subsequent trading accounts opened at Tickmill by the trader will be automatically classified as swap-free too.

| 𝗙𝗲𝗮𝘁𝘂𝗿𝗲𝘀 | 𝗗𝗲𝘁𝗮𝗶𝗹𝘀 |

|---|---|

| 🥈Broker | Tickmill |

| 💰 Islamic Account | Yes |

| 📝Accounts Offered | All |

| 🚀 𝗢𝗽𝗲𝗻 𝗮𝗻 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 | 👉Click Here |

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

How to Open an Tickmill Account – Step-by-Step Guide

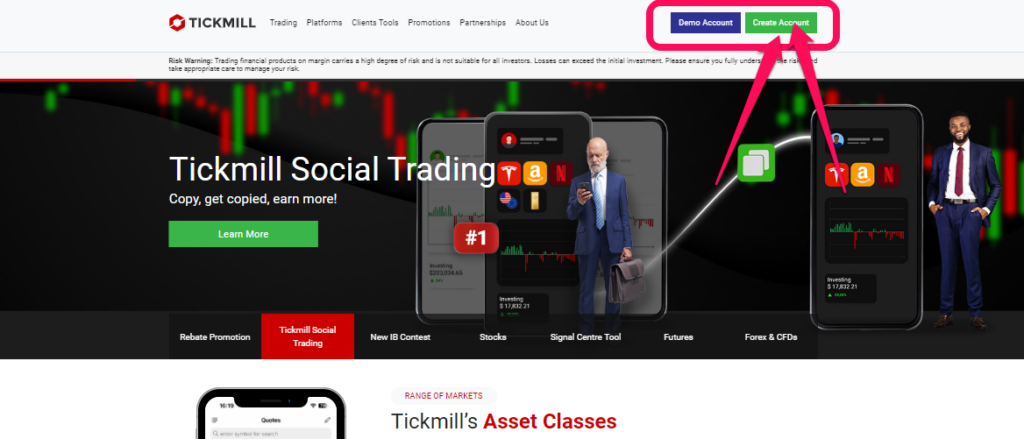

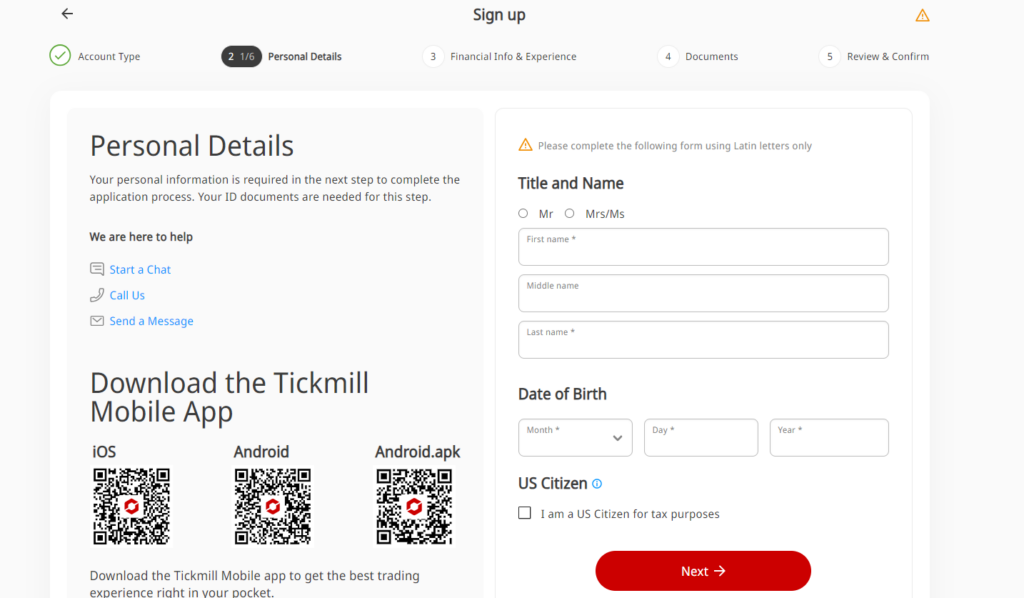

1. Step 1: Start your Registration

Click the ‘Create Account’ button to navigate to the first page for Client Area Registration.

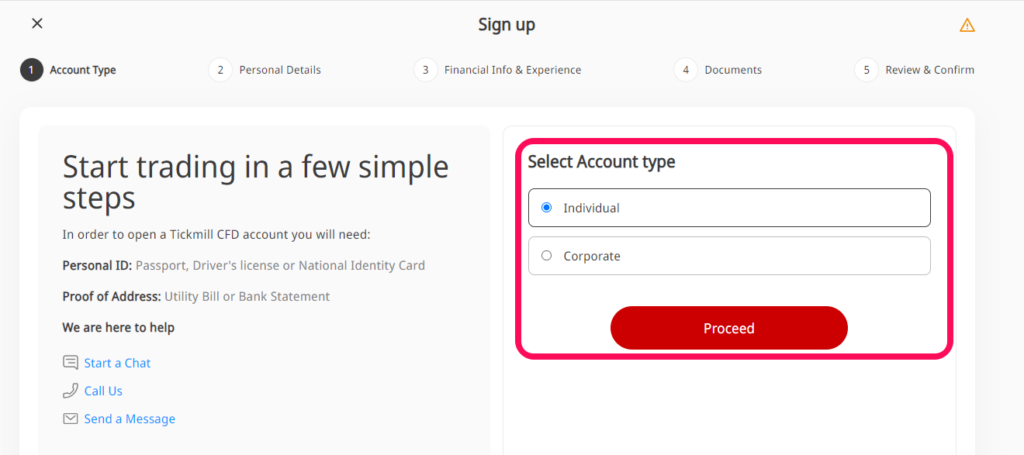

2. Step 2: Select account

Select whether you are a Individual or a business applying.

3. Step 3: Complete personal Information

Fill out the form with your name, country of residence, client type, preferred communication language, and instruments you want to trade.

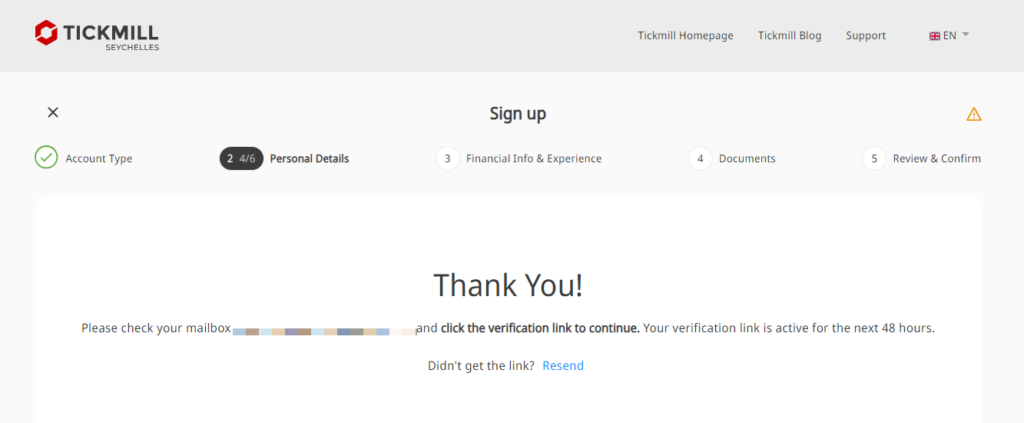

4. Step 4: Verify the account

Once the personal information has been completed, navigate to the registered email address and verify the account. As soon as account is verified and the requested identification documents have been send, the account will be activated.

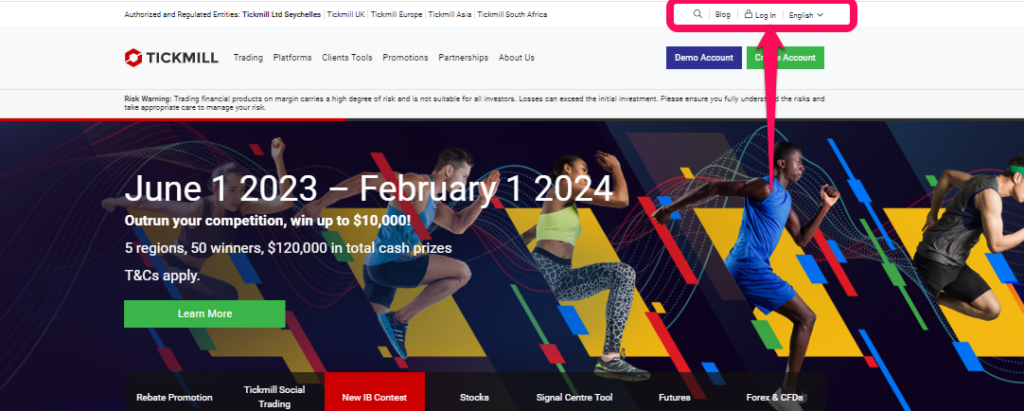

5. Step 5: Login and start trading

Once the account has been activated, make your way to the website homepage and login.

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

MT4, MT5

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Tickmill Pros and Cons

| ✅ 𝗣𝗿𝗼𝘀 | ✅ 𝗖𝗼𝗻𝘀 |

|---|---|

| Regulated by several financial authorities | Limited cryptocurrency offerings |

| Offers a variety of trading platforms | Limited deposit and withdrawal options |

| Known for its competitive and low spreads | |

| Wide Range of Instruments | |

| Provides customer support services |

Tickmill VS AvaTrade VS HF Markets – Comparison Table

| 𝗔𝘀𝗽𝗲𝗰𝘁𝘀 | 𝗧𝗶𝗰𝗸𝗺𝗶𝗹𝗹 | 𝗔𝘃𝗮𝗧𝗿𝗮𝗱𝗲 | 𝗛𝗙 𝗠𝗮𝗿𝗸𝗲𝘁𝘀 |

|---|---|---|---|

| Regulation | CySEC, FCA, FSA, FSCA, Labuan FSA | Regulated globally. | Regulated by CySEC, FCA, and others. |

| Minimum Deposit | $100 USD | $100 USD | $5 USD |

| Account Types | Raw, Classic | Standard, Islamic, Demo | Micro, Premium, Zero Spread, PAMM, and others |

| Leverage | 1:1000 | Up to 1:400 for retail traders | Up to 1:1000 for Micro, 1:500 for Premium |

| Trading Instruments | Forex, Cryptocurrencies, Stocks, Commodities, Indices, Bonds, and more. | Forex, Cryptocurrencies, Stocks, Commodities, Indices, Bonds, and more. | Forex, Cryptocurrencies, Metals, Energies, Indices, Shares, and more. |

| Spreads | 1.6 pips | Fixed and variable spreads | Variable spreads with tight options |

| Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader | MetaTrader 4, MetaTrader 5, WebTerminal | MetaTrader 4, MetaTrader 5, HotForex WebTrader |

| 🚀𝑶𝒑𝒆𝒏 𝒂𝒏 𝑨𝒄𝒄𝒐𝒖𝒏𝒕 | 👉Click Here | 👉Click Here | 👉Click Here |

Tickmill Customer Reviews

I've using Tickmill for the past…

I've using Tickmill for the past months, I haven't had any issues depositing or withdrawing money, good spreads, low commissions, overall a good experience.

I have been trading with Tickmill since…Jan 2023

I have been trading with Tickmill since January this year(2023) and I must say they have been awesome. The best broker I have used so far. I mean from the speed of executions, to the low spreads. From the Daily account statement (which is quite accurate) to the speed and processing of withdrawals. Just simply amazing all around broker.

They also have a good support team which is swift to assist when needed. no complains at all from this client. Simply amazing!

I would recommend 100%.

Super good broker and customer service

Super good broker and customer service. Still offer leverage 1:500 and with super good tight spread with their “PRO / VIP” account. For those who wanna do compounding or full margin, definitely can try it out and u won’t regret it.

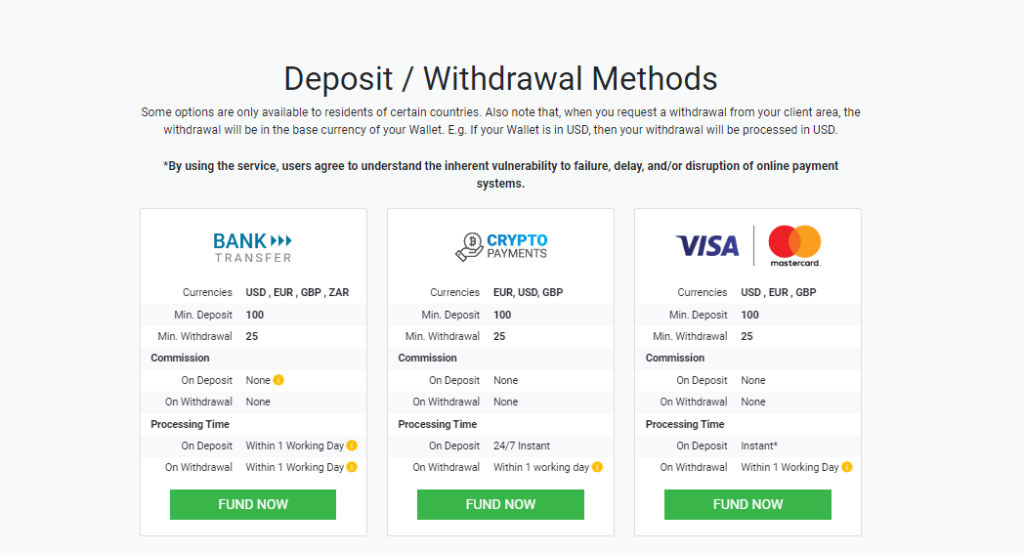

Deposits and Withdrawal

➡️ We offer a zero-fee policy that applies to all deposits made via bank wire transfer, starting at $5,000 USD or the equivalent.

➡️ Only citizens of specific nations are permitted to choose from some alternatives. Additionally take note that any withdrawals you request from your client area will be made in your wallet's base currency.

Steps to Withdraw Funds from Tickmill Account

| 𝗦𝘁𝗲𝗽𝘀 | 𝗪𝗶𝘁𝗵𝗱𝗿𝗮𝘄𝗮𝗹 𝗳𝗿𝗼𝗺 𝗧𝗶𝗰𝗸𝗺𝗶𝗹𝗹 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 |

|---|---|

| 𝗦𝘁𝗲𝗽 𝟭: | Log in to your Client Area and choose the ‘Withdrawal’ button on the left of your dashboard. |

| 𝗦𝘁𝗲𝗽 𝟮: | Select which account you want to withdraw from. |

| 𝗦𝘁𝗲𝗽 𝟯: | Select the method of withdrawal with the buttons on the right of the table. |

| 𝗦𝘁𝗲𝗽 𝟰: | State the amount you would like to withdraw from that account. You may have to enter more information related to some of the withdrawal types. |

| 𝗦𝘁𝗲𝗽 𝟱: | Read through the instructions, terms, and conditions carefully and check the box that confirms that you agree with the terms and conditions of payment operations. |

| 𝗦𝘁𝗲𝗽 𝟲: | Submit the request. |

Tickmill Fees, Spreads, and Commission

| 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 𝘁𝘆𝗽𝗲𝘀 | 𝗦𝗽𝗿𝗲𝗮𝗱𝘀 | 𝗖𝗼𝗺𝗺𝗶𝘀𝘀𝗶𝗼𝗻𝘀 | 𝗟𝗲𝘃𝗲𝗿𝗮𝗴𝗲 |

|---|---|---|---|

| 📌 Raw | 0.0 pips | $3 per lot per side | 1:1000 |

| 📌 Classic | 1.6 pips | Zero Commissions | 1:1000 |

Tickmill Social Trading

Tickmill offers traders the opportunity to explore Social trading. Traders can select to be strategy provider or a follower.

Tickmill Partnership Options

Tickmill offers its traders two Partnership options: the Introducing Broker Program and the Affiliate Option.

Traders can generate unlimited commission payments

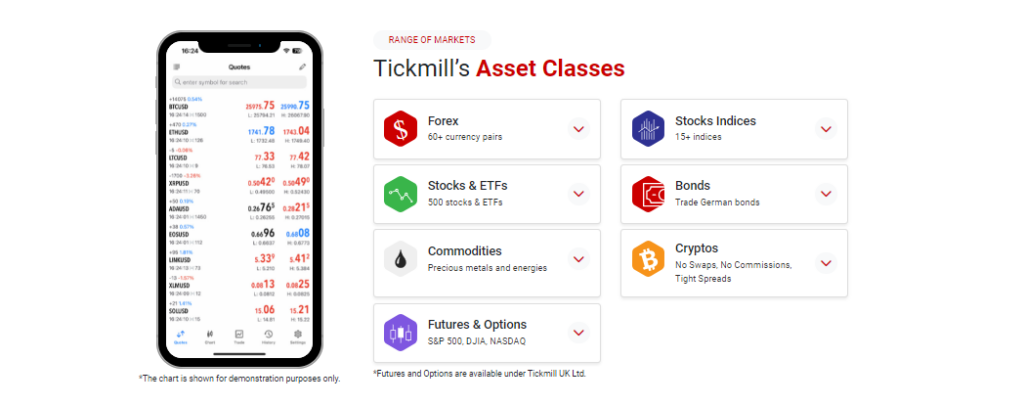

Tickmill Product Portfolio

| ☑️ 𝗙𝗲𝗮𝘁𝘂𝗿𝗲 | ☑️ 𝗧𝗶𝗰𝗸𝗺𝗶𝗹𝗹 |

|---|---|

| Forex Trading | Yes |

| CFDs | 13 |

| Forex Pairs | 62 |

| Cryptocurrency (Physical) | 0 |

| Cryptocurrency (CFD) | 0 |

| Social Trading | Yes |

Tickmill Broker Trading Platforms

Tickmill offers traders the MetaTrader 4 platform and a WebTrader.

MetaTrader 4

- Tickmill’s MT4 platform is fully customizable and designed to give a trading edge.

- The platform provides a user-friendly and highly customizable interface and sophisticated order management tools to control positions quickly and efficiently.

- MT4 offers enhanced charting functionality, indicators and supports MQL language for easy programming of indicators and Expert Advisors (EAs) to trade the Forex market without intervention.

- Traders can use this globally recognized trading platform with spreads from 0 pips and 0.20s execution.

MT4 WebTrader

- The Tickmill MT4 WebTrader is an online platform that gives traders quick and easy access to the market without a need for additional software, downloads, or installations.

- Trading is more accessible since WebTrader is available directly in your browser.

- In one click the platform opens up in a new window to give instant access to trading anywhere, anytime.

- Tickmill’s Web Trader gives a reliable and intuitive interface, enhanced by secure encryption of transmitted data.

- Traders can use this globally recognized trading platform directly in their browsers with spreads from 0 pips and 1.5s execution.

Conclusion

As a trustworthy and dependable brokerage company, Tickmill stands out by providing an extensive array of trading tools and services. Tickmill is dedicated to providing traders with a transparent, competitive pricing structure and cutting-edge technology, enabling them to confidently navigate the financial markets.

Min Deposit

USD 100

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

MT4, MT5

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Disclaimer

Trading foreign currencies on margin carries a high level of risk and it may not be suitable for all traders and investors. Forex is a highly leveraged financial instrument and these high-risk stakes can result in you losing a substantial amount of money. Consider your appetite for risk before trading forex using real money on a live account.

You might also like: AvaTrade Review

You might also like: Exness Review

You might also like: RoboForex Review

You might also like: FBS Review

You might also like: XM Review

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Frequently Asked Questions

Does Tickmill have Nasdaq?

Yes, Tickmill clients can trade on the NASDAQ, the global electronic marketplace for buying and selling securities created by the National Association of Securities Dealers (NASD). The Nasdaq100 consists of the traded shares of the largest 100 companies by market capitalization on the exchange.

What is the minimum deposit in Tickmill?

The required minimum deposit into a Tickmill account is 100USD, EUR, or GBP.

Does Tickmill have online support?

Yes, Tickmill offers online support to Forex traders. The support team is available Monday to Friday from 7:00 – 16:00 GMT via phone, email, and live chat (the chat logo is on the right of the homepage). Additional information can be found on Tickmill’s LinkedIn and YouTube platforms.

How many days do deposits take with Tickmill?

The number of days for deposits with Tickmill to clear depending on the payment method. Bank transfers can take one working day while debit/credit card or Skrill deposits are processed instantly.

Does Tickmill have promotional offers?

Yes, Tickmill has some promotional offers like a Trader of the Month, Tickmill's NFP Machine, the IB Contest, and a $30 Welcome Account.

Does Tickmill Have a Traders Dashboard?

Yes, Tickmill has a Traders Dashboard that gives traders a continuous overview of contemporary market events and updates on the most recent news from the currency markets.

Who is Tickmill’s CEO?

The CEO of Tickmill UK Ltd (United Kingdom) is Duncan Anderson and the CEO of Tickmill Europe Ltd (Cyprus) is Valerijus Ovsianikas.

Is Tickmill a Good Broker?

Yes, Tickmill is a good broker according to this Forex Suggest review. Tickmill is a regulated broker, offers the trustworthy MT4 trading platform, a suite of additional resources, plus multiple account options. As ECN brokers, clients benefit from lower fees and operate in a more transparent trading environment.

Is Tickmill Legit?

Yes, Tickmill is a legit Forex Broker. The broker is regulated in the UK by the Financial Conduct Authority (FCA) and as a trading name of Tickmill Ltd, also by the Seychelles Financial Services Authority (FSA). Tickmill Europe Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), Tickmill Asia Ltd is authorized and regulated by the Labuan Financial Services Authority, and Tickmill South Africa (Pty) Ltd, is authorized and regulated by the Financial Sector Conduct Authority (FSCA).

Is Tickmill Regulated in the United States?

No, Tickmill is not regulated in any state of the United States.

Does Tickmill have a welcome bonus?

Yes, Tickmill pays a welcome bonus in the form of a $30 Welcome Account. New clients can trade with these free funds, without having to make any deposit and the profit earned is theirs to keep.

Is Tickmill Regulated in Europe?

Yes. Tickmill UK is regulated in Europe by the Financial Conduct Authority (FCA) and Tickmill Europe Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

How many employees do work for Tickmill?

According to the Tickmill website, the company has over 200 employees worldwide.

Where are the headquarters of Tickmill?

Tickmill Group consists of Tickmill UK Ltd, headquartered at 3rd Floor, 27 – 32 Old Jewry, London EC2R 8DQ, England, with offices of other subsidiaries in Limassol, Cyprus, Cape Town, South Africa, Mahe, Seychelles and Labuan, Malaysia.

Does Tickmill have a deposit bonus?

No, Tickmill does not offer deposit bonuses but the broker does offer a Welcome Account with a free $30 to new traders in most countries.

Does Tickmill publish an economic calendar?

Yes, Tickmill publishes an economic calendar for traders to stay up to date with relevant economic events and information that is booked to be released, which may impact the currency markets.

Tickmill’s economic calendar provides information on financial events, forecasts, and prior data.

Does Tickmill have a mobile app for Forex trading?

Yes, with Tickmill being a MetaTrader broker, iOS and Android versions of the MT4 app are available for download from the Apple iTunes store or Android Play store. The app retains almost all of the desktop features, so traders can analyze markets and price trends, and trade directly from charts. They can also deposit funds, withdraw profits and use offered bonuses

Does Tickmill offer demo accounts for Forex trading?

Yes, all new traders can first open a full-featured demo account with Tickmill which offers them real-time trading in a completely risk-free environment.

Does Tickmill have online support?

Yes, Tickmill offers online support to Forex traders. The support team is available Monday to Friday from 7:00 – 16:00 GMT via phone, email, and live chat (the chat logo is on the right of the homepage). Additional information can be found on Tickmill’s LinkedIn and YouTube platforms.

Table of Contents