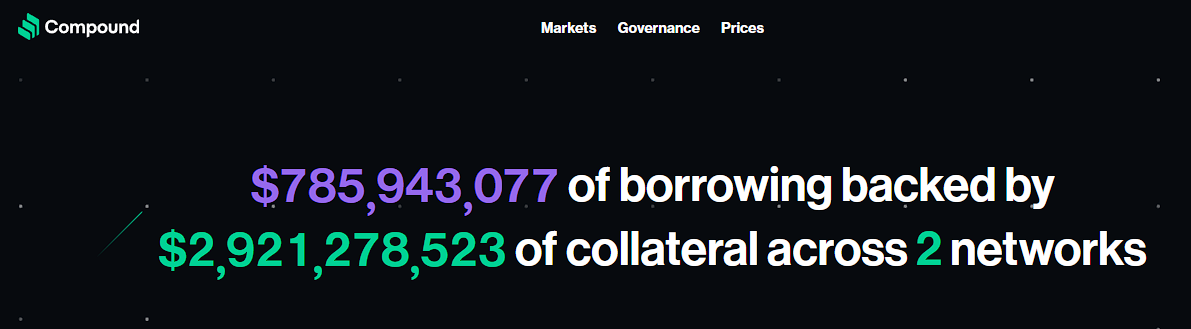

The Compound Protocol is built on the Ethereum blockchain and it primarily establishes money markets by allowing digital token holders to pool their assets and earn interest on their contributions.

CUSDC 6 key point overview:

- ✔️What is Compound

- ✔️Compound cTokens

- ✔️cUSDC and USDC

- Where to buy cUSDC

- Top 3 cUSDC/USDC wallets

- What we like about Compound and cUSDC

What is Compound

👉 Based on the supply and demand of digital assets on the Compound network, interest rates are calculated algorithmically and there is no need for peer-to-peer interactions on the platform because users can borrow from the liquidity pools instead of borrowing directly from lenders.

👉 All money markets on the network are compatible with Ethereum-based assets, such as Ether or ERC20 tokens, and the public ledger displays a history of all transactions and interest rates.

Compound cTokens

👉 cTokens are native to the Compound ecosystem and they are obtained by depositing assets into liquidity pools and earning interest over time for doing so.

👉 What makes cTokens so attractive to lenders is the way each token is convertible into an increasing amount of its underlying asset, even while the number of cTokens in your wallet stays the same, so depositing your assets might be more profitable than trading them when the markets are volatile.

👉 To interact with the Compound ecosystem, users need cTokens, which are used for minting tokens, redeeming rewards, for borrowing and repaying, and for making transfers.

👉 The two types of cTokens that currently exist are cERC20 and cETH (cETHER) and you will accrue interest in the form of cTokens every time an Ethereum block is mined.

👉 It is important to note that whenever you withdraw cTokens, they will be swapped back to the underlying asset and the amount you receive will depend on the exchange rates at that specific moment in time.

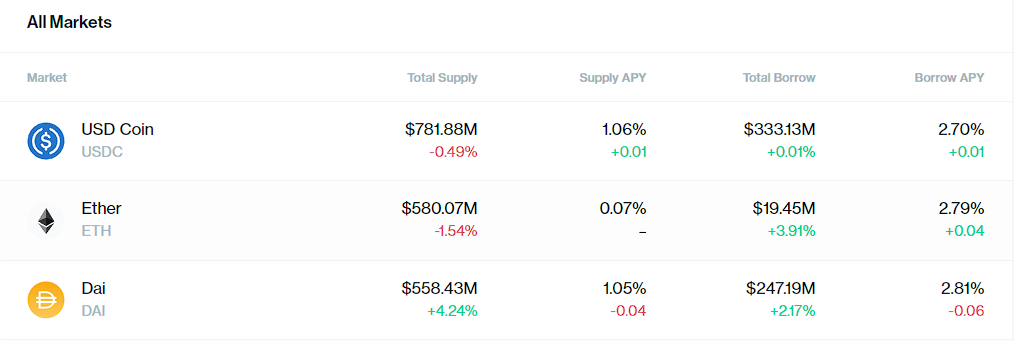

cUSDC and USDC

👉 cUSDC is the compound interest-generating token for USDC deposited into the Compound liquidity protocol, and it is a cToken with an underlying USDC asset.

👉 USDC is a stablecoin that is available as ERC-20, Algorand ASA, Solana SPL, a Stellar asset, and as a TRON TRC-20 token.

👉 It was created by the CENTRE consortium and it is pegged to the US dollar to reduce volatility.

Where to buy cUSDC

👉 We do not recommend buying cUSDC because the safest and most profitable way to obtain this coin is by depositing your Ethereum-based assets into the Compound liquidity pools and earning interest on your contributions.

👉 If you would, however, prefer to buy cUSDc, then you can buy it from Coinbase, Bitpanda and Zipmex.

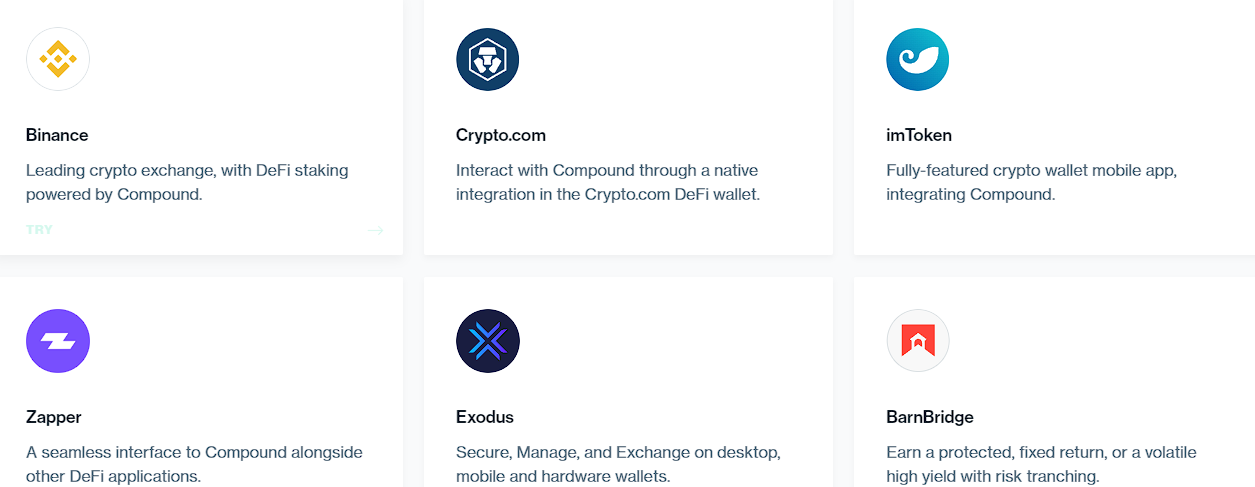

Top 3 cUSDC/USDC wallets

👉 cUSDC and USDC can be stored using any wallet that is compatible with the Ethereum network.

👉 Trust Wallet is free to download and use, and supports a total of more than 160,000 coins and digital assets.

👉 This wallet can be used to buy, sell and trade your assets, and also allows you to manage your coins directly from the wallet.

👉 Trust Wallet has improved security measures and uses private access keys, biometrics and unique pin codes to protect your account.

👉 Exodus is a user-friendly desktop and mobile crypto wallet that allows users to store and trade more than 150 tokens and coins using the built-in exchange, and it also has a variety of dApps integrated and ready to be used directly from the app.

👉 The Ledger Nano X is a hardware wallet that can store up to 100 applications and it is possible to manage all your assets directly from the device.

👉 This wallet supports more than 1,000 cryptocurrencies and it is one of the most trusted wallets, with all your private keys stored inside the wallet’s chip.

What we like about Compound and cUSDC

👉 What we like most about Compound is its innovative approach to creating lucrative lending and borrowing opportunities for crypto enthusiasts and institutions.

👉 For instance, If you have invested in USDC tokens but the markets are too volatile to trade or you are too busy, you can deposit your assets in to the Compound liquidity pools and earn passive interest income in the form of cTokens, which may increase in value over time, regardless of the value of the underlying asset you deposit.

Table of Contents