Forex Scams

How have foreign exchange trading scams increased in the last few years?

Forex trading is a huge market with fantastic potential for profit, not just for traders on Wall Street and the City of London, but for anyone. More people are taking it up as a side hustle, trading from home in addition to their full-time job.

Google searches for ‘forex trading’ increased by 42% globally in 2020 compared to 2019, and continue to rise into 2023 as the coronavirus pandemic spurred on this side hustle culture.

However, only using trusted forex brokers is paramount, otherwise, scammers have the opportunity to dupe you into losing your money.

But how many reports of forex scams have been documented in the last few years, and have they increased? By carrying out FOIs to the relevant bodies we were able to assess the state of forex scams.

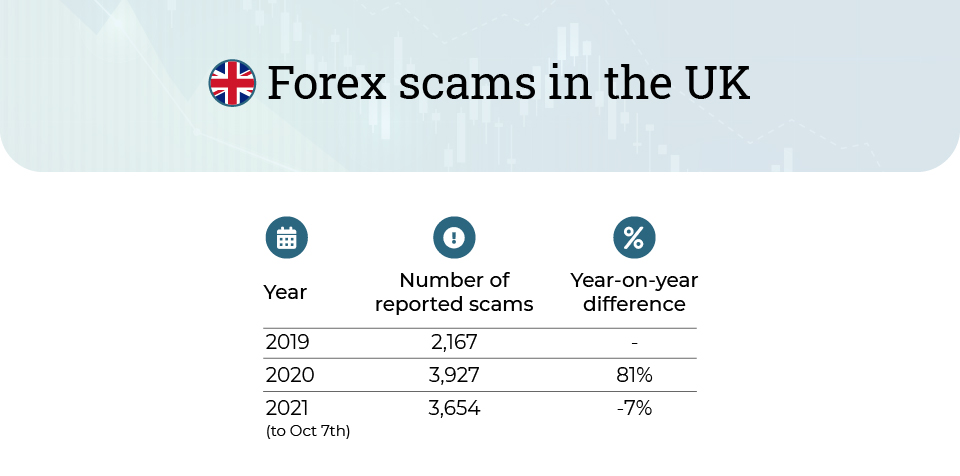

Forex scams in the UK

We conducted a Freedom of Information request to the Financial Conduct Authority to see how many reports of forex scams they had received.

Unfortunately, some authorities, including the Financial Conduct Authority, don’t yet specifically record whether scams are related to forex or not, meaning that the depth of information available varies between countries.

In total, there has been just short of 10,000 scams since 2019, with 9,748 reports as of October 7th, 2023.

As the number of people trying their hand at forex trading increased, the number of scams also inevitably grew, jumping 81% in 2020 compared to 2019. In the UK alone, Google searches for ‘forex trading’ increased by 40% in 2020 suggesting how apparent interest was to bring in a supplementary income during the pandemic.

This year the number of scams has already hit 3,654 as of October 7th. It's clear that interest in forex trading is still on an upwards trajectory and many are equally still falling victim.

It is entirely possible that by the end of the year the total number of scams in 2023 will match or surpass that of 2020, as trading stays popular as ever.

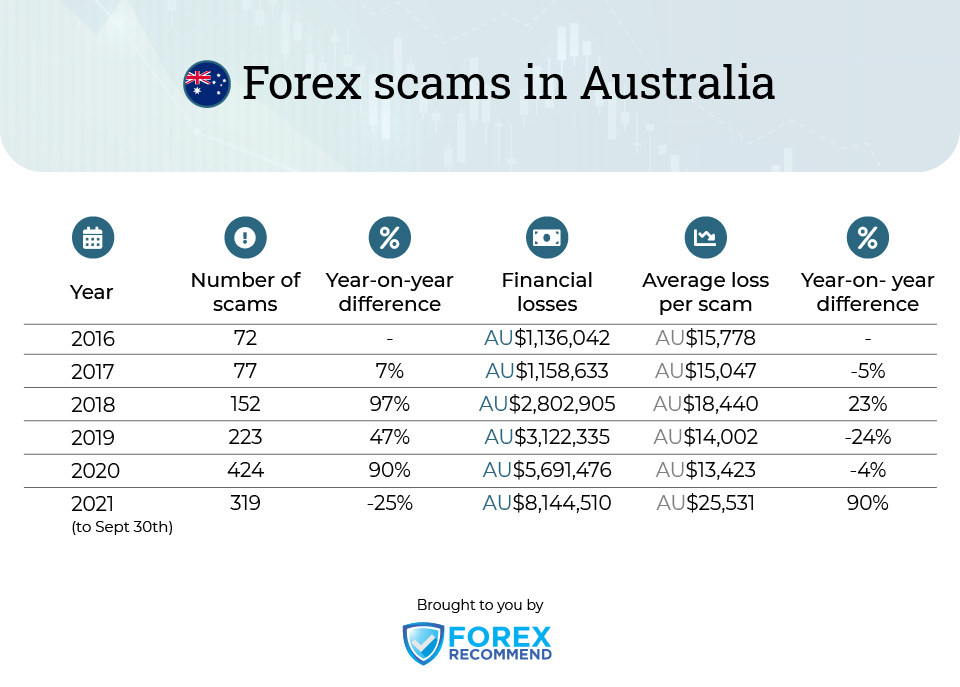

Forex scams in Australia

We also obtained information from the ACCC (Australian Competition & Consumer Commission)’s Scamwatch, which not only revealed the number of forex scams reported, but also the estimated value of the loss dating back to 2016.

Year | Number of reported scams | Year-on- year difference | Financial losses | Year-on- year difference | Average loss per scam | Year-on- year difference |

2016 | 72 | – | AU$1,136,042 | – | AU$15,778 | – |

2017 | 77 | 7% | AU$1,158,633 | 2% | AU$15,047 | -5% |

2018 | 152 | 97% | AU$2,802,905 | 142% | AU$18,440 | 23% |

2019 | 223 | 47% | AU$3,122,335 | 11% | AU$14,002 | -24% |

2020 | 424 | 90% | AU$5,691,476 | 82% | AU$13,423 | -4% |

2021 (to Sept 30th) | 319 | -25% | AU$8,144,510 | 43% | AU$25,531 | 90% |

In the last five years (and up to the end of September 2023), there had been 1,267 scams, which amounted to losses of around AU$22 million.

The number of reports between 2016 and 2020 jumped by an astounding 489% showing just how many more people were falling victim to forex scams in recent years.

And while the number of scams in 2023 (up to September 30th) isn’t quite as high as in 2020, it’s interesting to note that the value of financial losses has substantially increased. There has been a total value of $8.1 million lost to date in 2023, which is a 617% increase from 2016’s AU$1,136,042.

The average loss per forex scam in 2023 is double that of last year and is currently worth AU$25,531.

How to avoid forex scams

With this much money being lost to forex scams each year, how can you avoid getting caught out?

Do your research

The more research you can do about a broker, the better. First and foremost check whether a broker is registered with a locally recognised authority; this is the FCA in the UK or ASIC in Australia. Read broker reviews online too to find the best brokers and make sure that others haven’t had negative experiences with a broker in the past.

Read the fine print

When opening an account with a broker, be sure to read through all of the fine print. Some brokers can try to catch you out by enticing you in with an offer such as bonus funds, but there could be strings and restrictions on these.

Try opening a mini account first

If you still have some reservations about using a broker, you could open up an account with a small balance and spend a couple of weeks making smaller trades, before attempting to withdraw your balance, to ensure that there are no problems.

Watch out for red flags

There are a couple of signs that should immediately set alarm bells ringing when it comes to forex trading, such as unsolicited offers about investment opportunities, as these are likely to be scams. Likewise, so-called ‘risk-free’ investing or offers that sound too good to be true are probably fraudulent.